My journey to discovering the Supplementary Retirement Scheme (SRS) was born out of a quest to optimise my personal finances and minimise my annual tax burden. It was during one such research session that I stumbled upon the SRS, a financial vehicle that not only promised tax savings but also held the potential to secure my retirement future.

What is the Supplementary Retirement Scheme available in Singapore?

The Supplementary Retirement Scheme (SRS) forms a crucial component of the Singaporean government’s multifaceted approach to address the financial challenges posed by an aging population. Established in 2001, the SRS operates within the private sector and aims to empower Singaporeans to proactively save for their retirement years.

This is somewhat similar to the Private Retirement Scheme in Malaysia. I wrote an article about it some while back: Private Retirement Scheme (“PRS”) – To invest or not to invest?

Why invest in the Supplementary Retirement Scheme?

SRS helps you save for retirement

For foreigners employed in Singapore, the lack of compulsory CPF contributions, a privilege exclusive to Singaporean citizens and PRs, can present a hurdle when it comes to securing a solid retirement fund, especially for those who require consistent reminders to save. The SRS is a viable alternative for foreign individuals seeking to secure their retirement funds.

SRS contributions are voluntary, and foreigners can also participate!

This voluntary nature of the SRS is a key differentiator. SRS members have the autonomy to decide on the amount they wish to contribute, within prescribed limits, based on their individual financial goals and circumstances. These contributions can then be strategically invested in a range of financial instruments, providing you with an opportunity to grow their retirement savings over time.

For foreigners employed in the Lion City, who are not eligible for CPF contributions, the SRS offers an attractive avenue to secure their financial future. It allows them to harness the benefits of Singapore’s thriving financial sector and enjoy potential tax advantages while building a robust retirement fund.

SRS contributions are tax deductible

One of the primary motivations for investing in the SRS is its attractive tax relief, which offers substantial benefits to both foreign individuals and Singaporean citizens and PRs. This tax incentive empowers individuals to significantly reduce their annual tax liabilities by contributing to their SRS accounts, effectively lowering their taxable income.

The appeal of this tax incentive becomes even more evident when comparing the limited personal income tax reliefs available to foreigners in Singapore as opposed to those in Malaysia.

This SRS tax incentive serves a dual purpose:

- It enables individuals to defer a portion of their tax payments until later, providing immediate financial flexibility.

- In retirement, the SRS allows individuals to potentially pay less in taxes, especially if they plan their withdrawals strategically. With proper planning, it’s even possible to enjoy tax-free withdrawals every year during retirement.

Do note that to maximise your tax relief, you will need to contribute to the annual limit by 31 December of each year.

When you withdraw your SRS funds after reaching the retirement age, you will only be taxed 50% of the amount you withdraw for the calendar year. From the time the first withdrawal is made, you have a period of up to 10 years to make your withdrawal.

SRS contributions are investable

To maximise the growth of your SRS savings, consider investing them. This approach can potentially earn you higher returns, as your SRS balance earns just 0.05% annual interest. Additionally, investing in your SRS account allows you to accumulate tax-free returns on your investments.

Your cash in the SRS account doesn’t need to remain idle; it can be put to work. You have the flexibility to invest in a diverse range of investment products, including:

- Bonds

- Singapore Government Securities (SGS) and Singapore Savings Bonds (SSB)

- SGD Fixed Deposit

- Foreign Currency Fixed Deposits

- Shares

- Single Premium Insurance

- Unit Trusts

Eligibility Criteria

To begin your journey with SRS, you must initiate an SRS account with one of the three prominent local banks in Singapore: DBS, OCBC, or UOB. However, before doing so, you must ensure that you meet all of the following eligibility criteria:

- Age Requirement: You must be at least 18 years old.

- Financial Standing: You should not be an undischarged bankrupt.

- Mental Capacity: You do not have a mental disorder and are capable of managing yourself and your affairs.

| Important Note: You will not be permitted to open a new account if you previously had an SRS account which was closed after withdrawing all the monies due to the following reasons: – Having attained the prescribed retirement age*; or – On medical grounds. *The statutory retirement age that was prevailing when you made your first SRS contribution. |

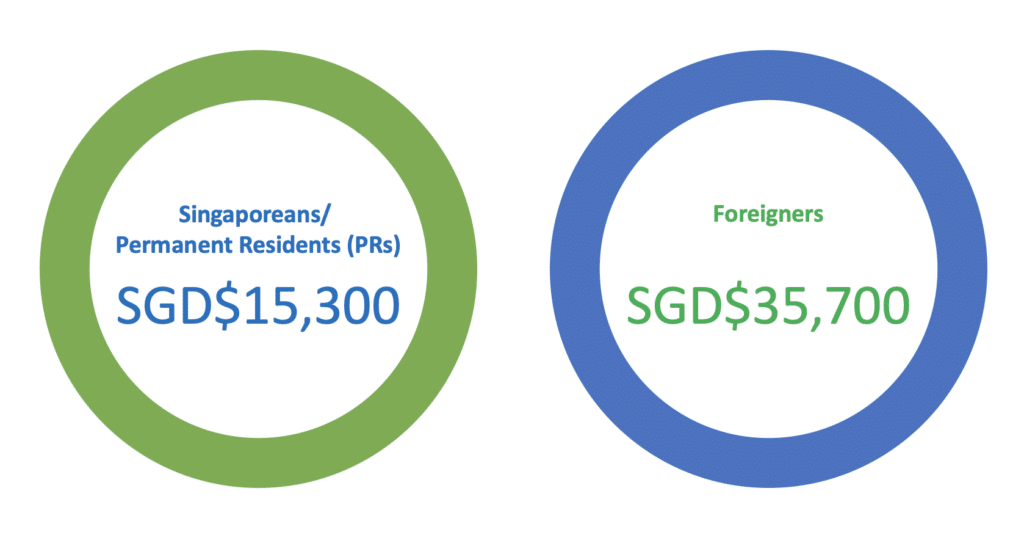

How much can I contribute to SRS?

Foreigners employed in Singapore have the advantage of being able to contribute a more substantial amount to their SRS account each year when compared to their Singaporean and PR counterparts. At time of writing, the contribution limits are:

- Foreigners : $35,700 annually;

- Singaporeans and PRs: $15,300 annually.

It’s important to note that by default, you are allocated the lower contribution limit. To increase this limit, you must declare your foreigner status by submitting a Declaration Form for SRS (For Foreigners) to your respective SRS bank operator.

Are there any catches in investing in Supplementary Retirement Scheme?

There’s an early 5% penalty if you withdraw before retirement age

The most significant drawback of investing in SRS is the imposition of a 5% penalty on withdrawals made before reaching the statutory retirement age (currently 63 at time of writing). Additionally, the entire withdrawn amount becomes subject to tax.

For instance, if you decide to withdraw $10,000 from your SRS account before the age of 63, you will face a penalty of $500 (5%). Furthermore, the full $10,000 will be added to your taxable income for that tax year.

Hence, you should only contribute to your SRS account if you are reasonably confident that you won’t require the funds in the near future. Otherwise, the 5% early withdrawal penalty could offset any tax benefits you initially enjoyed.

However, it’s worth noting that there are exceptions to this penalty. Withdrawals under specific circumstances, such as:

- Death – Exempt from 5% penalty, and taxed 50% of withdrawal amount

- Medical grounds – Exempt from 5% penalty, and taxed 50% of the withdrawal amount

- Bankruptcy – Exempt from 5% penalty, and taxed 100% of the withdrawal amount

If you’re a foreigner, you can withdraw from your SRS account without the 5% penalty if you meet all of the following criteria:

- You are neither a Singapore Citizen nor a SPR on the date of withdrawal and for a continuous period of 10 years preceding the date of withdrawal;

- You have maintained your SRS account for a period of at least 10 years from the date of your first contribution to your SRS account; and

- You make a one-time full withdrawal from your SRS account.

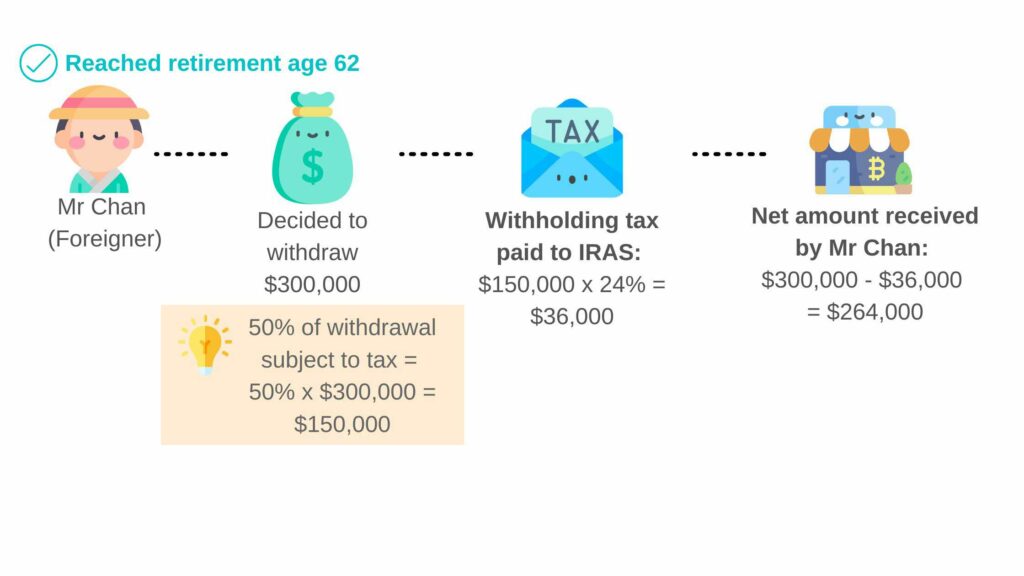

For such withdrawal, you will be taxed 50% of the withdrawal amount. Remember, you need to make a full and not partial withdrawal.

If you’re a foreigner when you withdraw, the tax levied upon withdrawal might be higher

Further complexity arises in the tax calculation for expatriates, depending on their tax residency status at the time of withdrawal.

- Singapore tax resident: Your tax will be calculated based on the progressive tax rate applied to residents.

- Not a Singapore tax resident: The actual tax payable on the SRS withdrawal will be 15% or the progressive resident rates, whichever is higher.

It’s crucial to understand that while a withholding tax is applied to SRS withdrawals by expatriates, this is not the final tax liability. The withheld tax is merely a credit that offsets your actual tax liability. This means that any unused tax credit will be refunded to you.

In terms of withholding taxes, expatriates who withdraw from their SRS accounts will have 50% or 100% of the withdrawn amount subject to a withholding tax, depending on the type of withdrawal. The SRS bank operator will withhold this tax at the prevailing non-resident tax rate of 24%* (effective from YA2024) at the time of withdrawal, which will then be remitted to the Inland Revenue Authority of Singapore (IRAS).

| Note: With effect from 1 Jul 2014, the concessionary withholding tax rate of 15% will apply if the following conditions are met: i. Cumulative amount withdrawn by the SRS account holder in the calendar year does not exceed $200,000; and ii. The SRS account holder does not have any other income besides the SRS withdrawal(s) during the calendar year when the withdrawal(s) are made. To enjoy this concession, the SRS account holder must declare that he fulfils the two conditions above using the Form IR37B(1). The Form IR37B91) is obtainable from the SRS operator. |

Should you invest in Supplementary Retirement Scheme if you’re a foreigner?

Before deciding to invest in the SRS, it’s crucial to take various factors into account. One of the primary considerations is the duration of your stay and work in Singapore.

Furthermore, The attractiveness of the tax benefit hinges on your taxable income bracket. To put it simply, contributing to your SRS account becomes a financially astute choice when you are liable to pay income tax in Singapore. If your income is not subject to taxation or falls within the relief cap, there might not be an immediate tax advantage to contributing to your SRS account for the current year.

In summary, the SRS serves as a versatile and accessible retirement planning tool designed to meet the diverse needs of Singapore’s population, including both residents and expatriates. It offers tax benefits that become more appealing as your income rises, making it a strategic choice for many individuals seeking to optimise their long-term financial planning and tax management strategies. Based on my rough calculations, you should start to see significant tax savings if you hit the 11.5% tax bracket onwards.

More detailed information about SRS can be found in the SRS booklet published by the Ministry of Finance Singapore as of 7 December 2017.

| Disclaimer: The above is solely the author’s point of view. Our content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstance. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. |