Did you know that staking crypto on Luno is now possible? Just recently, Luno announced that they now allow the staking of Ethereum on their platform. If you’re new to the crypto space, you might be wondering – what exactly is and how does staking work?

Check out: My views on Cryptocurrency and Luno Platform

| Did you know? When I first wrote about Bitcoin in December 2020, the price of Bitcoin was USD18,312 per unit. Now it’s a whooping USD52,000. At time of writing, that’s about 41.61% annualised return. Annualised Return = ((Ending value of investment / Beginning value of investment) ^ (1 / Number years held)) – 1 |

What does staking mean in Crypto?

Staking refers to the practice of locking crypto assets for a predetermined duration to contribute to the operational integrity of a blockchain. In exchange for staking your crypto, you receive additional cryptocurrency as a reward. Analogous to depositing cash in a high-yield savings account, where banks utilise your deposits by lending them out, staking involves participants committing set amounts of cryptocurrency to support the blockchain.

Many blockchains use a proof-of-stake (POS) consensus mechanism. Under this system, network participants who want to support the blockchain by validating new transactions and adding new blocks must “stake” set sums of cryptocurrency. Typically, a qualification criterion involves possessing 32 ETH, but Luno uniquely imposes no minimum requirements.

Staking serves the crucial function of ensuring that only legitimate data and transactions are incorporated into a blockchain. The increased presence of validators staking their assets enhances the overall security of the network. This heightened security arises from the increased difficulty for any single validator or group of validators to manipulate and approve an invalid transaction.

In the event of improper validation leading to the inclusion of flawed or fraudulent data, participants may face penalties, risking a partial or complete loss of their stake. Conversely, accurate validation of legitimate transactions and data results in participants earning additional crypto as a reward.

Prominent cryptocurrencies like Solana (SOL) and Ethereum (ETH) have incorporated staking into their consensus mechanisms as an integral part of their blockchain operation.

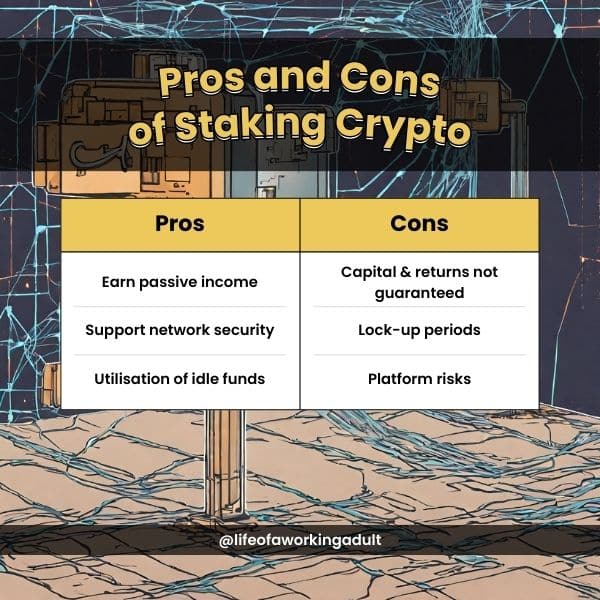

What are the benefits of staking crypto?

Earn passive income on idle funds

One of the primary advantages of staking is the opportunity to earn passive income in the form of additional cryptocurrency rewards. Validators or participants who lock up their crypto assets and actively contribute to the network’s security and functionality receive rewards for their efforts.

If you stake on Luno, it varies depending on the amount of stakers on the network. But typically, you can earn rewards of up to 3.6% per year on the amount of Ethereum staked. Although it states that you can earn up to 3.6% per annum in the app, it’s may vary depending on the market. It’s also good to note that Luno also takes 1.1% as a service fee.

Support network security

Staking plays a crucial role in the security of proof-of-stake (POS) and other consensus mechanisms. By participating in staking, individuals help secure the network by validating transactions and blocks, making it more resistant to attacks and ensuring the integrity of the blockchain.

Is there any risk in staking crypto?

Capital and returns are not guaranteed

Validators or stakers may face slashing penalties if they fail to fulfil their responsibilities or act maliciously. Slashing involves the deduction of a portion or all of the staked assets as a penalty. Validators may be penalised for actions such as going offline, validating invalid transactions, or other forms of misconduct.

The staking platform or service chosen for participation may also face technical issues, security breaches, or operational challenges. You should thoroughly research and choose reliable and well-established staking providers to minimise platform-related risks.

Luno’s staking provider, Blockdaemon, stands out as one of the industry’s most trusted service providers, maintaining an impressive track record of 99.9% uptime to-date. The validator node is subject to 24/7 monitoring, supported by backup nodes on standby in case of unforeseen issues. While slashing incidents are exceptionally rare, in the unlikely event that your staked crypto faces penalties, Blockdaemon has established procedures for reviewing and addressing slashing penalties where commercially reasonable.

Lock-up periods

Staking typically involves locking up funds for a specified period. During this lock-up period, you may not have immediate access to your staked assets. If liquidity is a concern, you should consider the duration of the lock-up period.

The value of the staked cryptocurrency can fluctuate due to market conditions. Stakers may be exposed to price volatility, and if the value of the staked assets decreases significantly, the overall returns from staking could be impacted.

Luno is good in this aspect, because the estimated unstake duration takes about 1 day, and the reward intervals is every 7 days.

Should you start staking crypto on Luno?

If you find yourself with extra cash or already invested in cryptocurrency without an immediate need for those funds, staking could be a worthwhile consideration. Personally, I adopt this strategy as a means of potentially earning additional cryptocurrency rewards while actively contributing to the security and efficiency of the blockchain network.

However, staking may not be suitable for those bothered by short-term fluctuations in the asset’s price. If you need your funds back in the short term before the staking period ends, it’s advisable to avoid locking them up for staking. You should always review the staking terms, understand the duration of the staking period, and evaluate the time it would take to retrieve your funds upon withdrawal.

It’s crucial to only work with companies boasting positive reputations and high-security standards. If interest rates appear unusually high, it might be a scam. Always be skeptical.

Staking, like any cryptocurrency investment, carries a high risk of losses. Therefore, it’s essential to only stake money you can afford to lose. Assessing your risk tolerance, diversifying your investments, and staying informed about market developments will further enhance your approach to managing crypto assets.

Sign up with Luno today!

If you’re interested to buy crypto, sign up for Luno! Click here or use my code “RF4S7“, deposit and buy MYR250 worth of crypto and you will get MYR75 in Bitcoin to kick start your journey in cryptocurrency. You’d be directed to sign up page, where you’d need to fill up some personal details and upload some documents to verify your identity. The entire process is pretty straight-forward and fast.

| Disclaimer: The above is solely the author’s point of view. Our content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstance. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. |