Have you heard of Private Retirement Schemes? It’s almost the end of the calendar year 2019! It’s time to get our taxes reliefs in order before the year ends. A little tax planning can go a long way in saving you that little bit of money from going to the tax coffers.

I’ll be writing this piece in a 5Ws (and 1H) approach (i.e. who, what, when, where, why and how).

| Did you know? Investing in Private Retirement Schemes (“PRS”) is eligible for a tax rebate of up to RM3,000 until the year of assessment (“YA”) 2025. |

Who are the providers of Private Retirement Schemes (“PRS”)?

There are 8 approved providers approved by the Securities Commissioner as listed below:-

- Affin Hwang Asset Management Berhad

- AIA Pension and Asset Management Sdn Bhd

- AmFunds Management Berhad

- Kenaga Investors Berhad

- Manulife Investment Management (M) Berhad

- Principal Asset Management Berhad

- Public Mutual Berhad

- RHB Asset Management Sdn Bhd

Each provider has a different kind of fund which varies in terms of asset allocation and product mix. You should always pick a fund to invest according to one’s own risk appetite and retirement goals.

Under each provider there will be distributors (a.k.a. consultants / sales agents) of PRS. All PRS distributors have to be registered under the Federation of Investment Managers Malaysia (“FiMM”). However, you can DIY it on your own, either via PRS Online or through FundSupermart.

The Private Pension Administrator Malaysia (“PPA”) is the central administrator for PRS. They were introduced in 2012 and is tasked to protect PRS members’ interests and to educate the public on PRS.

What is PRS?

PRS was first introduced in 2012. As the name suggests, it’s a long-term investment scheme aimed to help you save enough for retirement. It’s a voluntary scheme, and it is meant to act like an extra safety net after EPF.

What makes it different from EPF is that you get to decide when and how much to contribute. You also get to decide the type of retirement fund that best suits you depending on your risk appetite.

Primarily, there are two categories of PRS – core funds and non-core funds, and within each it’s further subdivided into Syariah-compliant or not.

Core funds must be offered as a default option for PRS contributors, and are allocated based on different age groupings.

- Growth Fund – Below 40 years of age – Max. of 70% in E, 30% in FI and MMI

- Moderate Fund – 40 to 50 years of age – Max. of 60% in E, 40% in FI and MMI

- Conservative Fund – Above 50 years of age – Max. of 20% in E, 80% in FI of which 20% must be in MMI

(E: Equity; FI: Fixed Income / debentures; MMI: money market instruments)

Non-core funds differ from core funds in asset allocations and risk. These would suit investors with different needs and risk appetite.

When to invest in PRS?

You will never know when is the best time to invest in a fund (i.e. when the fund is priced at its lowest), nor will you know when is the best time to sell a fund (i.e. when the fund is priced at its highest).

Read also: StashAway Malaysia Review (2021) – Yay or Nay?

The best time to plant a tree was 20 years ago. The second best time is now. – Chinese Proverb

Where to invest in PRS?

Via PRS Online!.

Why invest in PRS?

There are a few good reasons to invest in PRS.

1) Tax relief of up to of up to RM3,000 until YA2021

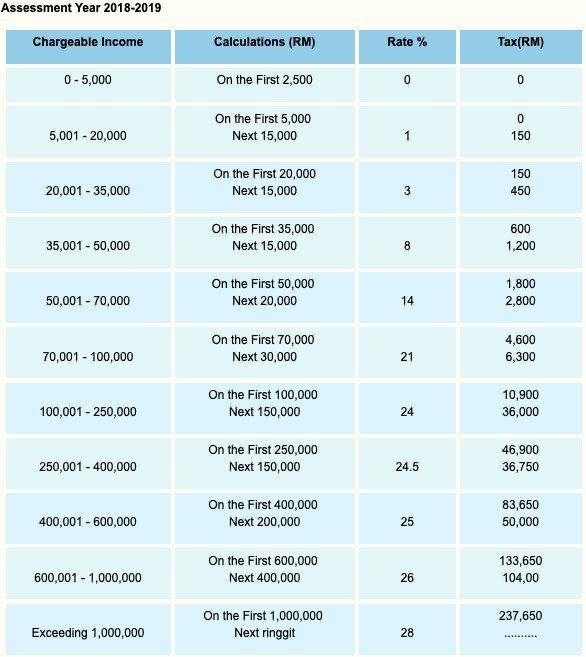

For example, let’s say your chargeable income is RM60,000 (i.e. RM5,000 a month), your tax rate is 14%. By investing RM3,000 in PRS, you will save RM420 in tax! In other words, it’s a guaranteed 14% return (assuming the performance of the PRS is profitable) before taking into account the performance of the PRS.

The higher your chargeable income, the more tax savings you get by investing in PRS. Hence, that’s why tax planning is very important as one progresses up in their career.

2) Diversification

It’s good to diversify your investment portfolio. You may have invested in equities, bonds, unit trusts, gold, bitcoin, etc. on your own, but one will never know how your investment might turn out in the long term. PRS is good in a sense that it’s run by professional trained fund managers that will help you meet your retirement goals.

However, don’t overdo it by investing in too many funds.

How to invest in PRS?

Step 1: Choose a PRS Provider and a fund

I would recommend comparing the historical returns of each available fund (for the full list click here). Although past returns are not a sure indicator of future returns, it’s a good benchmark to start with. It’s important to read and understand what’s the fund key characteristics, features, risk profiles and asset mix are. A good place to start would be by reading the Product Highlights Sheet and Disclosure Document before investing.

Do note that different funds might have different rates of fees attached. You may refer to the fees comparison here.

Step 2: Sign up an account via PRS Online

Here, you are required to fill in your personal details (and also to determine whether you are eligible).

Once you have uploaded the necessary documents and have been successfully verified, you can now select your preferred PRS Provider and fund to invest in, and thereafter proceed for payment.

Step 3: For further future top ups

You can either top up at PRS Online (with a RM0.50 administration fee) at the portal, or at the respective PRS Provider websites (sometimes with no additional fees!).

Other Considerations

On withdrawals

Your PRS account is structured like how EPF is structured. There are 2 sub-accounts under each retirement fund (sub-account A: sub-account B, at a 70:30 ratio). 70% of your contribution (sub-account A) can only be withdrawn when you retire at 55 (though there are certain conditions of which you may withdraw the amount earlier – like leaving the country for good, having disabilities, etc.), the remaining 30% (sub-account B) can be withdrawn once a year (but subject to a 8% tax penalty on the withdrawal sum).

So, don’t put in too much in PRS if you need to use the money in the near future.

On nominations

You can invest in PRS without making a nomination. However, you should get down in making one as soon as possible so that it’s easier for your next of kin to receive your gift in the event of your passing on. Without doing so, they might encounter difficulties when making a withdrawal from your PRS account.

Steps on how to make a nomination can be found here.

Conclusion

I personally feel that it’s always good to set aside a sum of money for investment for the future. Since withdrawal from PRS isn’t fully allowed, treat it like an untouchable saving nest for retirement.

If you have not started any forms of investing, PRS is a good avenue to do so. It’s never too late to start investing. But better now, than later.

| Disclaimer: The above is solely the author’s point of view. Our content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstance. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. |