Have you ever heard of FSMOne Malaysia (previously known as Fundsupermart.com Malaysia)? This is another tool whereby you can put your money to work.

What started as a small-scale financial services company in Singapore back in 2000, has grown and become a veteran in this region. They have since expanded their presence to four countries – Singapore, Malaysia, China and India.

They only landed in Malaysia in 2008. FSMOne Malaysia (previously known as Fundsupermart.com Malaysia) is the online unit trust distribution arm of iFAST Capital Sdn Bhd.

Read also: StashAway Malaysia Review (2021) – Yay or Nay?

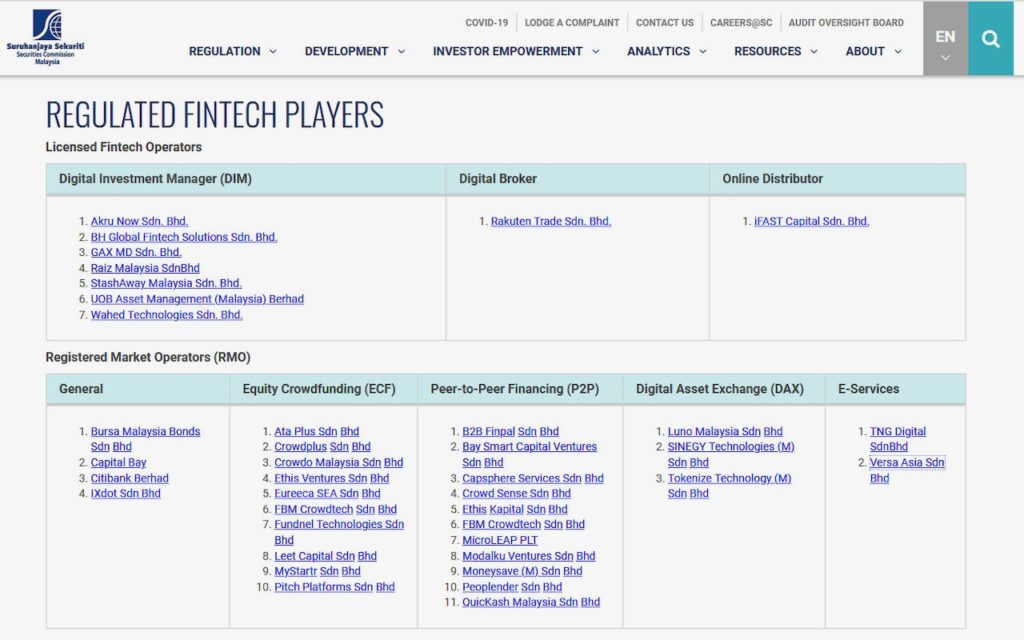

Is FSMOne Malaysia legal?

The first step before investing is to always check whether they are regulated by the Securities Commission (“SC”) Malaysia, and FSMOne Malaysia is. As you can see below, iFast Capital Sdn Bhd is not only regulated by the SC, but is the only regulated fintech player in the online distributor space in Malaysia at the time of this writing.

Key features of FSMOne Malaysia

| Criteria | Description |

|---|---|

| Instruments available | – Funds – Stocks – ETFs – Bonds – Managed Portfolios – Insurance |

| Fees | Funds Investment – 1.5% sales charge on equity funds, balanced funds, alternate investments and mixed assets. – 0% sales charge on bond funds and money market funds. – 0.05% platform fee for bond funds purchased using cash (not applicable to bond funds purchased using EPF monies and PRS funds). Stocks / ETFs i) Malaysia – Processing fee: 0.05% or minimum MYR8.80 – SST: 6% – Stamp duty: MYR1.00 for every MYR1,000 contract value (max MYR200) – Clearing fee: 0.03% on contract value (max MYR1,000) ii) Hong Kong – Processing fee: 0.08% or minimum HKD50.00 – Stamp duty: MYR1.00 for every MYR1,000 contract value (max MYR200) – HKEX stamp duty: 0.13% round to the nearest dollar – Exchange settlement fee: 0.004% minimum HKD 5.00 / CNY 5.00 / USD 5.00 – SFC transaction levy: 0.0027% – Trading fee: 0.0050% iii) US – Processing fee: 0.08% or minimum USD8.80 – Stamp duty: MYR1.00 for every MYR1,000 contract value (max MYR200) – Activity fee for sell transaction: USD0.000119 per share (min USD0.01 / max USD 5.95) – SEC fee for sell transaction: USD 0.00051% on contract value (min USD0.01) – Corporate action charges: USD 50 + USD100 deposit (withdrawal at custodian) Notes for all: – No platform charges. – No dividend handling fee from FSMOne. Bonds: – Retail corporate bonds: > Processing fee: 0.5% of nominal value (min MYR8.80) > Platform fee: 0.045% per quarter – Wholesale corporate bonds: > Processing fee: 0.5% of nominal value (min MYR35 or equivalent currency USD35, etc.) > Platform fee: 0.045% per quarter – Malaysia government bonds: > Processing fee: 0.1% of nominal value (min MYR8.80) > Platform fee: 0.02% per quarter Managed Portfolios: – Subscription fee: 0 – 1.0% depending on what portfolio – Management fee: 0.50% per annum (charged on quarterly basis) |

| Platforms | Website or their own app for mobile. |

Why do I like FSMOne Malaysia?

When I first used this platform, it was mainly to invest in Unit Trust. I have been investing in Unit Trusts (“UT”) for more than a decade. It seemed easier to just let the professional run it at first, I thought. Professional here refers to the banks. Well, after almost a year of actively making my own research and own purchases of UTs, I have come to a conclusion that if you are that sort of person who has the patience to do your own research and monitoring, this platform will actually work for you.

| Pros | Cons |

|---|---|

| ✓ Competitive low commissions / fees ✓ Accessibility and lower starting minimums ✓ Easy access to information ✓ Easy monitoring of your holdings ✓ Provides investment advice ✓ Promotions ✓ Beneficiary accounts option available | ✖ Limited global exchange options ✖ Limited asset classes |

Reason 1: Competitive low commissions / fees

The first thing that I like a lot about using FSMOne Malaysia is that their fees are much more competitive. FSMOne Malaysia charges you a sales charge of 1.5% for a standard purchase of UTs.

If you buy the same UT at the bank, the sales charges often run between 3% to 5%. Yes, you may get an extra reduction of these charges if you are a privileged customer of the bank as the sales charge might be lowered to 1% during your birthday months. But that benefit is only available to the privileged group, and not to all. FSMOne Malaysia brings you that little bit of savings in sales charge (i.e. 1.5% – 3% in savings) which can be quite significant in the long run.

Of late though, some banks have been quite aggressive in promoting the UTs under them. Sales charges have gone down to as low as 0.75% during their promotional periods.

Reason 2: Accessibility and lower starting minimums

Another reason why I like investing with FSMOne Malaysia is the flexibility. When you buy UTs from banks, you are often asked to start with a bigger minimum initial investment, mostly running in tens of thousands.

In the past year, I have learned that with an online platform like FSMOne Malaysia, it is very easy to average down your purchase cost because you can buy in smaller amounts, and with the convenience of buying online, rather than visiting the bank and filling up the necessary paperwork. With this facility, the power of averaging down becomes very real. You can buy in small amounts over any period you desire. For many funds, the amount for subsequent investment is as low as RM100. You won’t be able to do that at a bank.

Also, at the banks, they will tell you that certain type of UTs (e.g. wholesale funds) are reserved for their privileged customers. But at FSMOne, it is possible to buy these funds. The minimum initial investment amount for these kind of UTs is usually set at a minimum of RM5K though, but still way lower than the amount set by the banks.

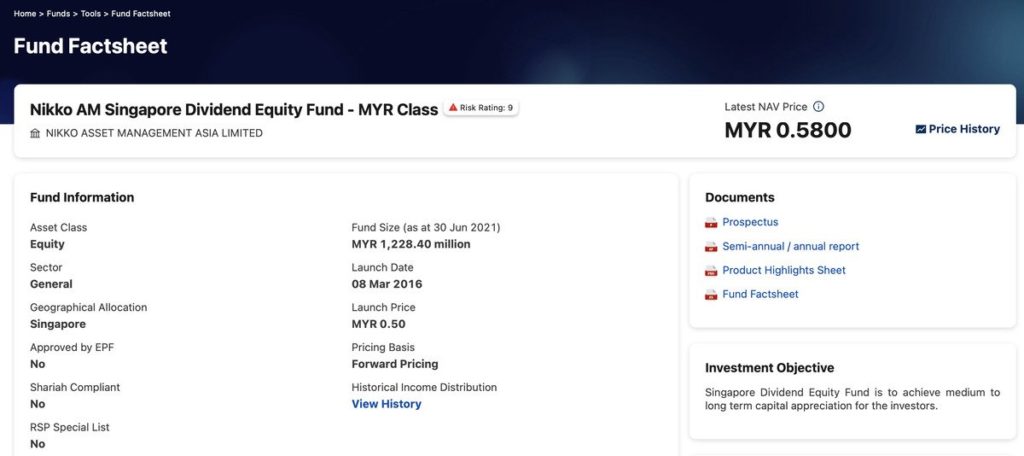

Reason 3: Easy access to information

At FSMOne Malaysia, information related to the funds are at your finger tips. Fund factsheet, prospectus, data regarding dividend returns or the historical high or low prices of the UT are all easily accessible. This definitely beats having to sit at the bank for hours at end sometimes to listen to them being shown or read out to me. Just because that someone at the bank explains to you, you pay the extra 1.5% – 3% in sale charges. And when you try to do it in one sitting, trust me, a lot of things will slip through your fingers cos you just can’t remember all of them. With this platform, you can read repeatedly.

I like this easy access because I can now peruse any related data at my own time and pace. I personally feel that this helps me make a more informed choice. When an agent tries to sell a UT to you, there is always this sense of being rushed to make a decision (as they want to close the sale).

And if you want to know more about the funds that these feed into, there is always Google. In the past year, I’ve acquainted myself with many funds such as ARK, BlackRock, Vanguard, Schroeders among few others. I think I have learned more about possibilities more than anything. They are all just a few keystrokes away.

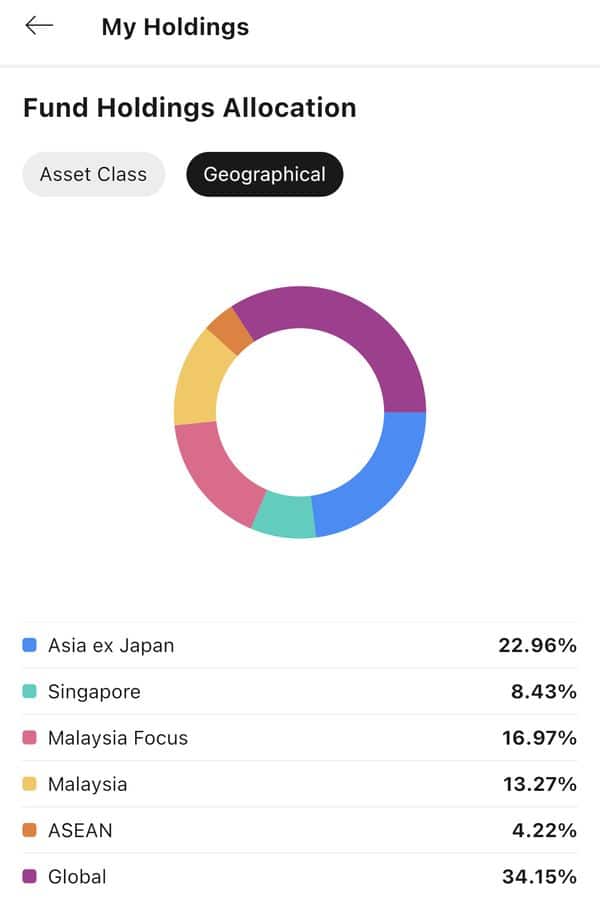

Reason 4: Easy monitoring of your holdings

The fourth reason is the monitoring. No longer do I need to go through my paper file to look for my UT portfolio. For those who know how these printouts look like, they are quite a pain to look through. Sometimes you need to spend hours just trying to locate the purchase and dividend payout receipts. And there are just so many fine prints too. Such endeavours often leave you worn out. Investment becomes an endeavour for those with long stamina.

On the FSMOne Malaysia platform, the list of your portfolio is all there for you to see, together with their profit/loss column. You no longer need to go to the bank to find out how well (or bad) your investment is doing.

Reason 5: FSMOne provides you with investment advice just like a traditional bank does

Next, the research or whatever advice given on FSMOne Malaysia can be quite insightful at times. They often hold webinars to better aid you in your investment journey. I have joined quite a few of them and found them to be quite educational.

Furthermore, you can always counter check or do more research on you own quite easily. Just a few extra clicks and you will be able to confirm the information that you want to know about a particular UT.

Also, if you are the kind that is lazy to do your own research, you can always buy into their managed portfolios. So far, the returns are still above the bank fixed deposit rates. For my Moderately Aggressive Portfolio, I have been able to get a return of an average of about 6%.

Reason 6: Promotions for reduced sales charges

They have offers of reduced sales charges. Within the last year, I’ve managed to participate in their usually month long promotions of 0%, 0.5% and 0.8% sales charge rates. The nice thing about these promotions is, you don’t have to be a preferred client to get them. Everyone can invest and everyone gets these offers. Plus you get to peruse them in your own time and in the comfort of your own home. You save a lot of time.

They also have tiered rewards for investors who invest a certain amount with them.

Reason 7: Beneficiary accounts option available

This would probably be the last in your priority list, but you can open up to 5 beneficiary accounts. In the event of the unfortunate event of a demise of the account holder, the beneficiary will inherit whatever investment made in his/her name. This one really gives meaning to investment with a peace of mind as it removes all the hassle of messy legal proceedings which are known to be associated with such a demise of an account holder.

One more thing, each time you open a beneficiary account, you get a month long sales charge of 1%. My advice is pick a time when prices are down and buy as much as you can. So, do your homework first and prepare the list of UTs that you are interested to invest in.

My Personal Experience

I’ve experimented with smaller sums ever since I hopped onto FSMOne. I’ve been able to sell within a short time of purchase due to buying at the right time. This would have been quite impossible to achieve with the bank because the Relationship Manager has no time to monitor individual accounts like you can for your own account. So add that to the reduced sales charges, you get better returns.

You are in the know all the time. No more depending on your RM to feed you with information. Anyway, in the years that I have been at this, it is hard to find a RM who can monitor your portfolio closely. Also many of them are often not very well informed enough.

My returns thus far

Overall, my returns have been better because I can call the shots more often. The averaging effect can really be felt. Also, the timing to sell is also now much improved because you have the data at hand. Personally, it is now possible to buy a UT and sell it a month later with a 12% profit because of the right timing. In the past year, I have been able to do this a couple of times. I think I never once was able to achieve this when I let the bank manage my investment.

I might write up a detailed comparison on the performance of FSMOne Malaysia’s managed portfolios against StashAway’s soon.

How do I select what Unit Trusts to buy?

Well, apart from the charts for the Best (and Worst) Return UTs, you also have all the other information to guide. There are the Performance Charts which I find very useful in checking out the price movement trend. There are also listing of highest and lowest prices for 1 year, 3 years and all time periods. And of course, there are all the information out there for you to read.

Ready to sign up? Use my referral link here! You get 30 days of 1% sales charge while I get 1 token for one purchase. Thank you.

Questions? Feel free to drop them in the comments.

| Disclaimer: The above is solely the author’s point of view. Our content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstance. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. |

2 Responses

Looking forward to your comparison vs stashaway.

It’ll be coming up real soon! Stay tuned! 🙂