So, you’re here because you have either bought a property or you are deciding to buy a property but are unsure about what you’re getting yourself into. The property agent has said that the property you’re interested in is a commercial titled development, but hey!… It’s a residential type property in a commercial titled development? It can get real confusing, real fast.

But fret not, I’m here to summarise my research when I was hunting for a property myself. Perhaps the my findings would somewhat ease in your quest of looking for answers.

Commercial-titled vs Residential-titled properties in Malaysia

Firstly, there are two types of property titles in Malaysia – (i) Commercial-titled, and (ii) Residential-titled. There are distinct differences between the two types of properties titles. This includes their intended use, legal protection, applicable taxes and utility fees.

Commercial-titled properties

Commercial-titled properties, given the name, are properties that are for business or business-related activities. These properties do not fall under the jurisdiction of the Housing Development Act (HDA). Also, this means that commercial rates and tariffs apply to these properties.

| Did you know? The Housing Development Act (HDA) safeguards the interests of buyers of primary market residential properties against licensed developers (they hold an Advertising Permit and Developer’s License (APDL)) for a specific period. A quick way to identify whether a property is protected under HDA is if it uses the standard Sale and Purchase Agreement – Schedule G for landed properties, or Schedule H for high-rise properties. |

Some of the more common commercial-titled properties that you may have heard of are serviced apartments, SoHos (Small office, Home office), SoVos (Small office, Virtual office), SoFos (Small office, Flexible office), and SoLos (Small office, Lifestyle office).

For service apartments and SoHos, since they are mainly used for residential purposes, they are protected under the HDA.

Residential-titled properties

Residential-titled properties include landed houses, condominiums and flats.

It’s pretty easy to differentiate condominiums and serviced apartments, those that have a retail element are serviced apartments, and those without are condominiums. This is because condominiums are designed for privacy and security to control the flow of unknown persons into the property.

A summary of the differences between commercial-titled and residential titled-properties

| Criteria | Residential-titled | Commercial-titled |

|---|---|---|

| Purpose of building | Residential only | For residential or business purposes |

| Assessment rates and utilities | Domestic rate | Commercial rate |

| Taxes | Entitled to once in a lifetime real property gains tax (RPGT) exemption | Service apartments are eligible for once in a lifetime RPGT exemption. The rest (i.e. SoHo, SoVo, SoFo, SoLo) are not entitled. |

| Legal protection | Falls under HDA’s jurisdiction and uses the standard Sales and Purchase Agreement (SPA) regulated under the HDA. Any disputes can be brought to the Tribunal for Homebuyer’s Claims. | Service apartments and SoHo fall under HDA’s jurisdiction and uses the standard Sales and Purchase Agreement (SPA) regulated under the HDA. Any disputes can be brought to the Tribunal for Homebuyer’s Claims. SoVo, SoFo, SoLo do not fall under the HDA’s jurisdiction. There are no standard SPA for commercial properties. |

Can you convert your commercial-titled properties to residential titled properties?

Yes. If you’re staying in a commercial-titled property, you can actually request and apply for your commercial tariff to be changed to domestic tariff via the myTNB portal.

| Did you know? TNB defines “Domestic Consumer” as a consumer occupying a private dwelling, which is not used as a hotel, boarding house or used for the purpose of carrying out any form of business, trade, professional activities or services. – Tariff Book by Tenaga Nasional Berhad |

One of the main reasons why homeowners want to convert their commercial property to residential property is because of the higher assessment rates and utility charges.

Read also: 5 Legit Ways to Earn Money Online

How to convert your TNB tariff from commercial to residential?

I recently submitted an application to TNB to change my tariff from commercial to domestic on myTNB portal. Overall, the application was pretty straightforward and smooth. My application was approved within 2 business days, which was relatively fast.

Here are the detailed steps on how to convert your TNB tariff from commercial to residential:

Step 1

Login to myTNB portal. After that, go to the menu bar above and click ‘Apply‘.

Step 2

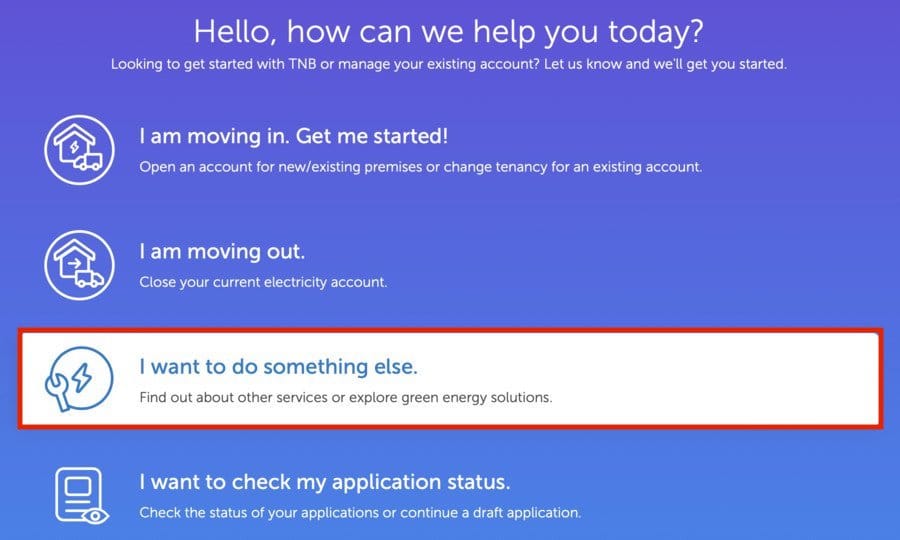

Select ‘I want to do something else.‘

Step 3

Select ‘I want to find out more about other services‘.

Step 4

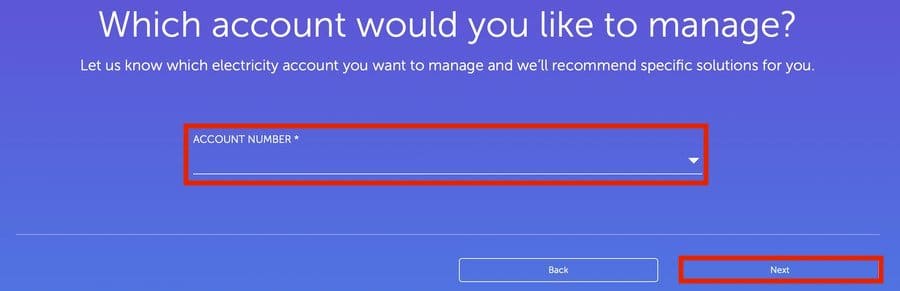

Select your account number from the dropdown. If you don’t find your account in the options given, there’s an option for you to add an electricity account. Click ‘Next‘.

Step 5

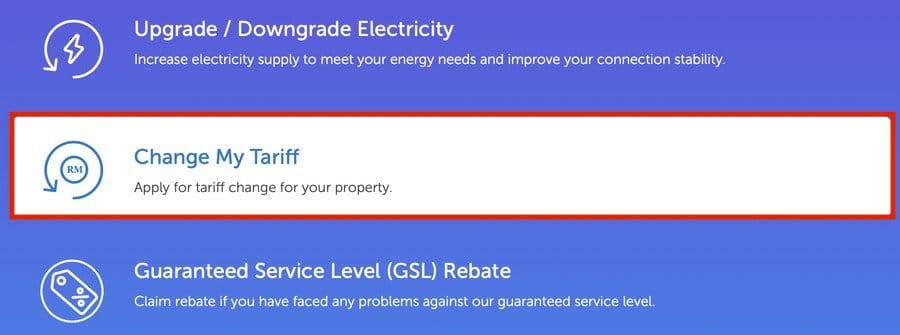

The page will extend for you to select more options. Select ‘Change My Tariff‘.

Step 6

You will be required to fill up an online form. Do make sure for premise type, select ‘Domestic‘ and select the residential type.

You will be required to submit a copy of your MyKad (IC). Do note that the name on your electricity bill must be the same as the copy of your MyKad.

Once you submit the application, a RM10 stamp duty will be charged to your TNB account, and will be reflected in your upcoming bill. You will receive email updates upon submission of your application, and subsequently regarding the status of your application (i.e. whether it was successful or not).