Most of us should know what EPF is, and what it is for. Do you know that you can actually self contribute to EPF through their EPF Self Contribution scheme?

What is EPF (Employees Provident Fund)?

In case you don’t already know, EPF is a federal statutory body under the purview of the Ministry of Finance. It is also known as KWSP (Kumpulan Wang Simpanan Pekerja). EPF manages the compulsory savings plan and retirement planning for private sector workers in Malaysia.

Based on the EPF Act 1991, both the employer and employee in Malaysia must contribute a portion of their monthly salary to EPF savings for retirement. Aside from this mandatory contribution, EPF members may also opt to make a voluntary contribution.

What is EPF Voluntary Contribution?

According to EPF’s website, there are 4 types of voluntary contribution, though in this article, I will be focusing more on self contribution.

The four types are:

- Self Contribution

This is a scheme where registered EPF members can make additional contributions to their EPF savings with any amount at any time. - i-Saraan

This is a government initiative for self-employed individuals who do not receive a monthly salary to contribute to EPF savings. You will receive a 15% government contribution subject to a maximum of RM250 per year (effective 1 Jan 2018) on top of your own contributions. This is however, only available till 2022. - Kasih Suri Keluarga Malaysia KWSP

This is another government initiative for housewives who are registered in the National Database on Poverty (e-Kasih). - Top-up Savings Contribution

This is a scheme where EPF members can top up EPF savings for their parents, spouse or children. Do note that in order for you to contribute under this scheme, you will have to prove your relationship by showing your birth certificate or marriage certificate.

All the 4 voluntary contribution schemes have the same objective, which is to encourage Malaysians to save for retirement. Compared to the others, the self contribution scheme has the least requirements. Read on for more details!

EPF Self Contribution

1. What are the requirements for EPF’s Self Contribution scheme?

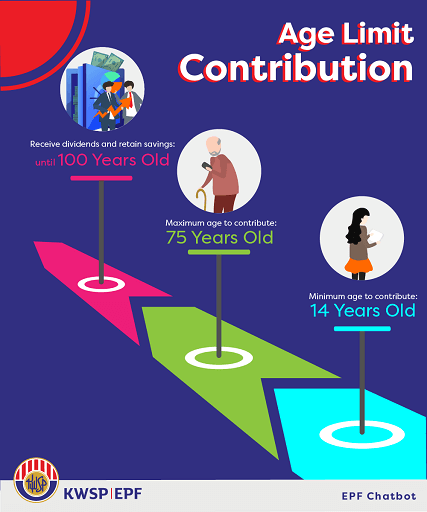

Self Contribution is a voluntary option for EPF members to make additional savings for retirement. To contribute voluntarily, you have to fulfil these criteria:

i. Malaysian/Permanent Resident,

ii. EPF member,

iii. Below 75 years old, and

iv. Contribution of not more than RM60,000.00 a year

This means that you can even self contribute to EPF even when you are working abroad, or working as a government servant, as long as you are a registered EPF member. One can contribute up to an aggregate of RM60,000 yearly for all of the Voluntary Contribution types.

Do note that you still can also make a self contribution although you are a salaried employee (i.e. working for an employer), and the contribution made from the compulsory contribution is not included in the RM60,000 cap for voluntary contribution.

2. Is there any minimum and maximum contribution amounts?

There is no minimum contribution amount, just a maximum of RM60,000 yearly.

3. What are the benefits of EPF Self Contribution?

✓ Helps you save for a bigger retirement nest

If you are a salaried employee or not, EPF Self Contribution is a great way to force yourself to save for retirement. Heard of the Malay idiom “sedikit-sedikit, lama-lama jadi bukit“? Literally, it means little by little, after some time it will become a hill. In this context, saving little by little, your retirement savings will grow into a hefty sum over the years.

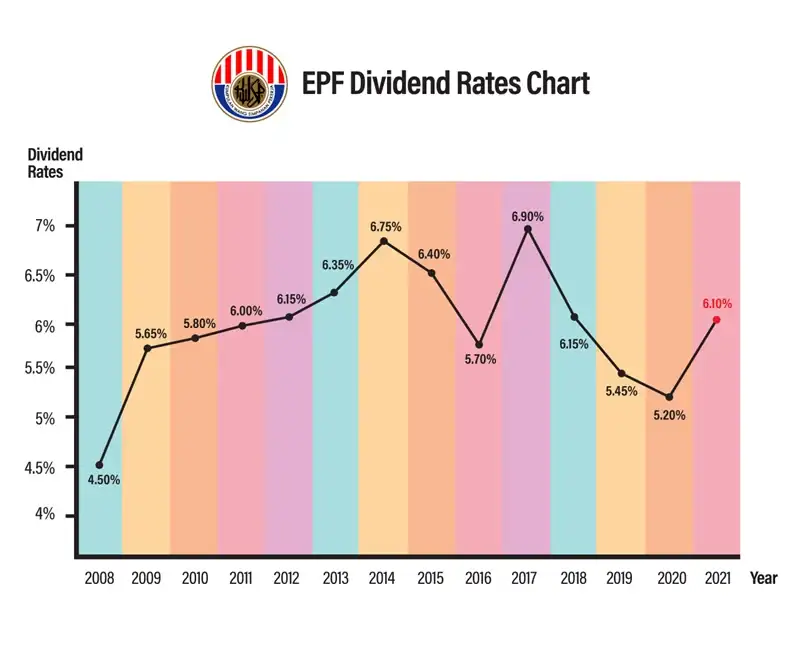

✓ Competitive annual dividends

Historically, the average EPF dividend rate for the past 10 years is 6.115%, which is impressive. So when you make an additional contribution vide the self contribution scheme, you get to reap the rewards from high EPF dividend rates.

Furthermore, with the power of compounding interest, you’ll be looking to double your money in about 12 years at 6.1% (based on Rule of 72).

| Did you know? The Rule of 72 is a quick, useful formula that is popularly used to estimate the number of years required to double the invested money at a given annual rate of return. |

✓ Maximise your income tax relief

Do you know that you can claim up to RM4,000 of income tax relief for contributions to EPF and other approved schemes?

Read also: Personal Income Tax Malaysia Guide for YA2021 [Excel Template Included!]

If you are not salaried and have mandatory deductions for EPF, you may want to take advantage of the tax relief by self contribution to your EPF account.

✓ Incapacitation and death benefit by EPF

All EPF accounts are eligible for incapacitation benefit of RM5,000 and death benefit of RM2,500 subject to EPF’s terms and conditions.

4. How to Self Contribute EPF?

There are 4 payment channels to perform a self contribution to EPF. My favourite mode of payment is Internet Banking, as you need not fill up or submit any additional forms.

Method 1: Internet Banking

You can make an online transfer using the following banks:

- MBSB Bank

- Maybank (M2U)

- RHB Bank

- Public Bank

- Bank Mualamalat

- Alliance Bank

- Hong Leong Bank

- Bank Islam

- CIMB Bank

- Kuwait Finance House

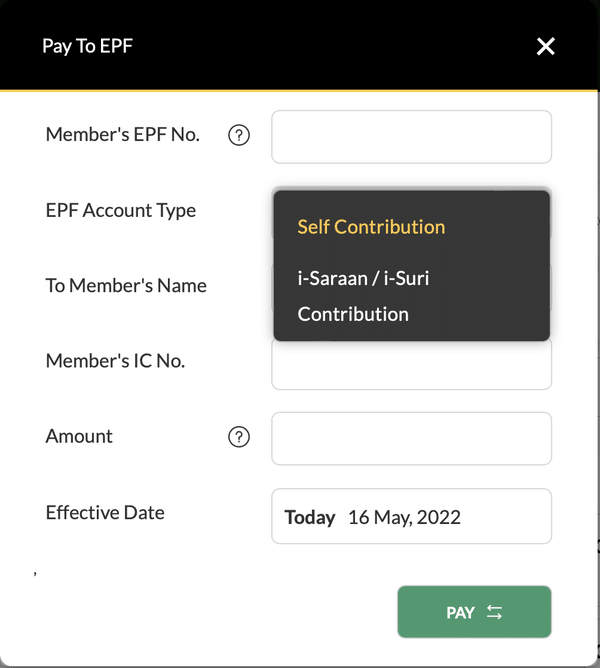

Contributions made through internet banking does not require any form submission.

Do however note to select the correct EPF Account Type when making a self contribution. You should choose “Self Contribution” or “Bayaran Caruman Pilihan Sendiri“.

Method 2: Bank Agent Counters

Do note that you’d need to fill up the Self-Contribution Payment Form – KWSP 6A(1).

Method 3: Registered Bank Agent

Other than selected bank agent counters, you can also make payments through Bank Agent (EB) BSN.

Method 4: EPF Counters

You can make cash payments of up to RM500 or cheque at all EPF counters nationwide. Do note that you’d also need to fill up the EPF Self Contribution Payment Form – KWSP 6A(1).

Final Thoughts

EPF is an easy way to save for your retirement with decent returns. There is no sales charge imposed by financial intermediaries unlike some investments. The only downside is that you can only withdraw from your EPF savings when you retire, or for approved reasons.

Check out also: