When Touch ‘n Go (“TnG”) introduced its new feature GO+ on 29th March 2021 it was supposed the first investment feature available on an e-wallet in Malaysia.

At a first glance, it seemed an attractive deal. Anchored to the Principal e-Cash Fund managed by Principal Asset Management, it is supposed to allow TnG e-wallet users access to low risk money market investment.

Read also: [Review] GO+ by Touch ‘n Go eWallet – The New Way to Save and Spend?

One month in using GO+

This post is about my experience after a month of using it. First thing to note is users can cash in their money into GO+ via FPX or from TnG’s e-Wallet. For users who top up their e-Wallet using credit card, it made perfect sense for them to top up their GO+ by cashing in to the Go+ account from the e-wallet. Thus, therein lies the quagmire that unfolded, and countless annoying emailing with their Customer Support.

The loophole? – Cashing to GO+ vide TnG e-wallet

The allowance to cash in from the e-wallet means many who saw this loophole taking opportunity of it. The loophole refers to the fact that a user can max out his credit card to top up his TnG e-Wallet, after which he’ll be able cash in to the GO+. So, why not do that that, right? When the credit card reaches its pay date, the user can then cash out from his GO+ to his bank account. And here, an issue cropped out.

Once the user cashes out the money, he will then find that all his credit cards will be blocked from topping up his TnG e-Wallet. And this is where TnG leaves their users irate and exasperated because they no longer can top up their e-wallet from their credit card. Who would want to use an e-wallet which does not allow top-ups from credit card when other e-wallets have that, right?

Furthermore, TnG will not inform you that your credit card has been blocked for further reloads, or to quote them “suspicious actives on your account”.

Customer Care-line Service – Poor

I first found out that I was unable to reload my e-Wallet via my credit card when I was in the midst of buying food from a restaurant. I had just cashed out everything from my GO+ the day before. Naturally, I wrote to their care-line inquiring about why was my reload function blocked.

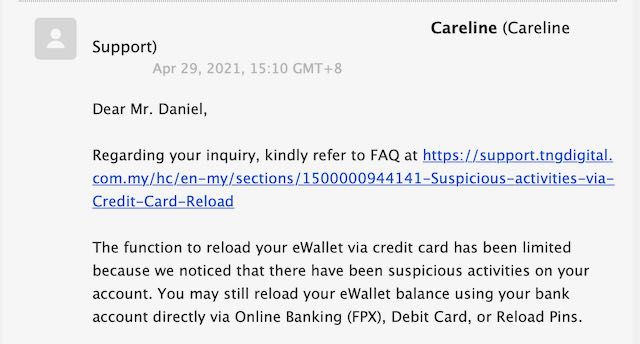

This was their response (link to their FAQ page for your reference):

In order for me to restore the full functionality of my e-Wallet account, I had to provide the latest credit card statement of the credit card I used to reload my e-Wallet. So, I complied to their requests with the documents asked. No response.

I followed-up with them a few days later. They replied indicating that upon checking in their system, they did not receive any documents from me. So, I sent the documents again. No response. This whole thing was repeated another three times. At some point, I began to suspect that their care-line inbox might not be able receive attachments.

Finally, I gave up. The process of trying to get them reactivate my account was just not worth it. Since the simple procedure of just reloading to the e-Wallet can’t be performed, I will just stop using them instead. Anyway, with the MAE system in place, vendors/retailers need not be e-wallet specific.

Also, I found this verification needed by TnG a little weird. Couldn’t they compare the name of the credit card that is used to top up against my name registered in their system for their own verification purpose?

Final Thoughts

Young people are quick to take advantage of loopholes when presented to them. In this case, the loophole is not even the users’ doing. Yet, TnG deemed it necessary to block because they didn’t foresee this. So it now feels like a case of them punishing the users for their own doing. Now, if you you have a service provider acting like this, what is there to stop them from wielding other measures, right?

The folks at TnG should have done their proper research, or set clear protocols / policies in place. For example, GO+ could have introduced a cooling period, whereby after a user has deposited a large sum into GO+, users could not cash out to their bank account for a certain period of time, but will still be able to use it from their TnG e-Wallet. This would have been better rather than just blocking these customers account with the excuse of suspicious transactions. For a TnGo to do as they did, I think it speaks volume about their service, and ultimately those who came up with this idea.

Read also: [Review] Versa – Duit Your Way – The New FD?

At the end of the day, the only loser here is TnG. Based on the comments on their Facebook page, I’m not the only one facing this issue. They will end up losing quite a number of its more informed users.