Looks like this year is the year that innovation hits the investment landscape in the Malaysian market. First Versa – Duit Your Way, now it’s Touch n Go Group. They have officially launched GO+, described as a financially inclusive investment product that allows TnG eWallet users and all Malaysians, to gain access to low risk money market investments for as low as RM10.

I have tested it out for myself, so here’s my review.

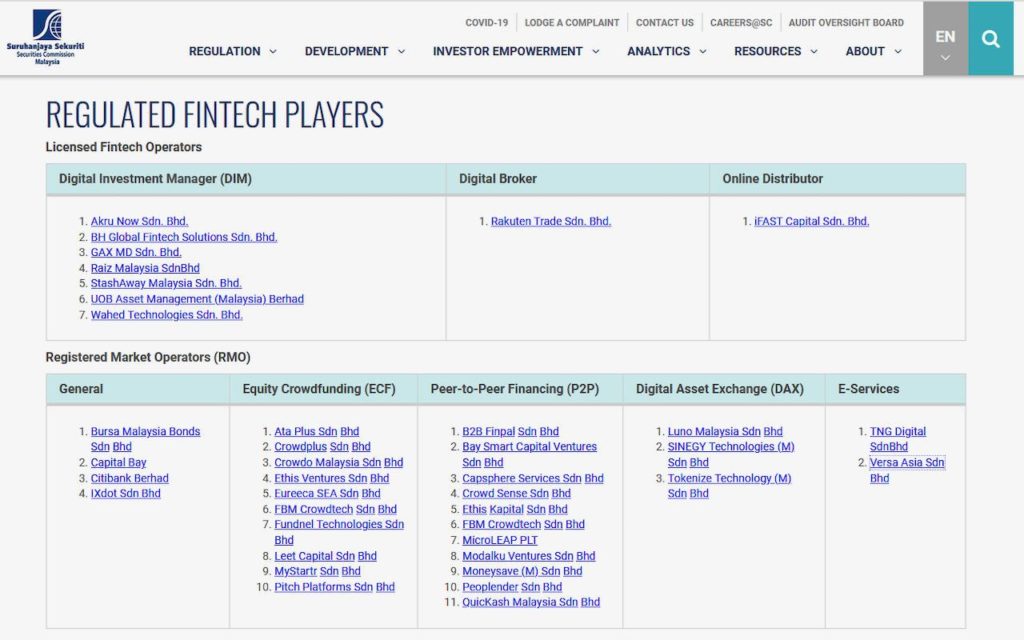

Are they regulated by the Securities Commission (“SC”) Malaysia?

When it comes to investing in Malaysia, the first step is always to check whether they are regulated by the SC, and they are! They are registered market operators for E-Services, like Versa.

Which is better – GO+, Versa or Fixed Deposits?

Here’s a summarised comparison:

| Criteria | Fixed Deposits | Versa | GO+ |

|---|---|---|---|

| Minimum tenure | 1 month tenure and above | None | None |

| Minimum deposit | Usually: RM5,000 for 1 month tenure; RM1,000 for 2 months tenure and above | RM1 | RM10, with a maximum amount capped at RM9,500 (individual limit per GO+ account) |

| Time taken for the deposit to be reflected in your account | Instantly | Up to 3 business days | Instantly |

| Capital guarantee | Yes, plus its insured by PIDM up to RM250,000. | No | No |

| Investment strategy | N/A | They invest in Affin Hwang Enhanced Deposit Fund. | They invest in Principal e-Cash (Note 1). |

| Interest rate | Determined and agreed upfront with the bank, though currently most banks offer way below 2.4% (as of Mar 2021). | Depending on the performance of Affin Hwang Enhanced Deposit Fund. Currently, they have a 2.4% per annum return on average. | Depending on the performance of Principal e-Cash. Currently, they have a projected return of 1.54% per annum. |

| Premature withdrawal | You get nothing but the initial deposit (and sometimes need to pay a penalty). | No minimum tenure – what you earned / see in the app is what you get. | No minimum tenure – what you earned / see in the app is what you get. |

| Time taken for the withdrawal to be reflected in your account | Instantly | Your withdrawal will take up to 2 business days to reach your bank account. | Your withdrawal will take up to 2 business days to reach your bank account / Instantly if to Touch ‘n Go eWallet (Note 2). |

| Any hidden / extra charges | None | None | None |

Note 1: GO+ invests in Principal e-Cash

Principal e-Cash (“Fund”) is a money market fund that is managed by Principal Asset Management Berhad. Principal Asset Management Berhad is managing nearly RM92.6 billion (as of December 2020) in assets under management.

This Fund is invested in a combination of cash (at bank), placement of deposits, money market instruments and/or debt instruments in MYR. Also, where opportunity arises, the Fund may also invest in high quality debt instruments for yield enhancement if the Fund managers are of the opinion that such investment will not compromise the liquidity and the performance of the Fund.

However, my only concern here is that this is a newly launched fund – this Fund was launched on 15 March 2021. Hence, there is no track record of the Fund’s performance. But generally, money market funds are relatively safe. To read the fund’s prospectus, click here.

Note: The aggregate GO+ account balances is currently capped at RM5 billion (“Aggregate Limit”). While a customer has an individual limit of RM9,500. At any point whereby the Aggregate Limit is reached, customers will not be able to Cash In to their GO+ account.

Note 2: The time taken for your withdrawal to be reflected in your account

With GO+, you have more options to cash out as compared to Versa. You can either cash out to your Touch ‘n Go eWallet or to your bank account. I’ve tried out both options, and it does hold true to its promises.

For withdrawal to:

- Touch ‘n Go eWallet

Your money will be credited instantly. - To bank account

Your money will be transferred within 2 business days, depending on the time of request of withdrawal.

Note: The name registered with your eWallet and bank account must match.

Why Do I Like GO+?

Reason 1 – Provide Access to Money Market Instruments

GO+ provides a platform to access to fixed income and money market instruments which would not otherwise be available to low net worth individuals like me.

Reason 2 – Principal e-Cash fund is managed by Principal Asset Management Berhad

Principal Asset Management Berhad, established on 13 June 1994, is a joint venture between Principal Financial Group and CIMB Group Holdings Berhad. Both entities are giants, with Principal Financial Group a member of the FORTUNE 500 and a Nasdaq-listed global financial services counter, and the CIMB Group Holdings Berhad, one of Southeast Asia’s leading banking group.

Plus, the joint venture is managing nearly RM92.6 billion as of December 2020 in assets under management and have won numerous awards. With such a stellar performance record, I think investing with them is pretty much safe.

Reason 3 – Flexible place to earn interest with no lock-in clauses or charges

The flexibility and convenience offered by GO+ is awesome! With no charges or lock-in periods, one can seamless place money into GO+ to earn extra interest!

GO+ can be funded via Touch ‘n Go eWallet or via FPX. Since you can reload your Touch ‘n Go eWallet using credit card, basically you’re able to fund your GO+ account using credit card (up to RM5,000 per day from your Touch ‘n Go eWallet). That means additional cashback if your credit card has cashback on your eWallet top-up transactions!

Furthermore, deposit placement to GO+ and withdrawals from GO+ to your Touch ‘n Go eWallet are instant. With this feature in place, I’d expect to see Touch ‘n Go eWallet gain market share from the other eWallet providers like Boost and maybe even Grab!

GO+ vs Versa – Which would be my preferred platform?

I would still use both just for different purposes. If you plan your finances well, you could potentially benefit from both at the same time. Here’s my benefit analysis for each platform:

GO+

- Convenient – You can spend straight from your GO+ account for purchases made via Touch ‘n Go eWallet.

- Flexible and fast – Deposits and withdrawals are (almost) instant from the Touch ‘n Go eWallet, plus you can pay your expenses from GO+.

- Can leverage on credit – You could use credit to actually invest since you can use credit card to top-up (potentially dangerous!)

- Potential double earnings – Cashback from the credit card top-up and daily earnings on the GO+ platform.

Versa

- Higher interest rate – The projected interest rate is 2.4% as compared to GO+ of 1.54%.

- Avoids overspending – Less flexibility to withdraw means lesser chance of you spending the money.

| Warning: Do note that both platforms do not guarantee your capital invested – meaning you could potentially lose all your capital if something goes wrong, nor is it protected by PIDM! |

| Disclaimer: The above is solely the author’s point of view. Our content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstance. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. |

2 Responses

thank you so much for your review. it has been informational especially when you highlight the contrast between those three. just one question: is it risky if we invest too much in GO+? Since you said that there is the potential of losing all the capital we invested.

While it’s generally safe to invest in GO+, and the risk of losing your capital is highly unlikely, I’d still recommend to not put all your eggs into one basket. Try diversifying into other investments.